The Facts About Hard Money Georgia Uncovered

Wiki Article

The 7-Second Trick For Hard Money Georgia

Table of ContentsHard Money Georgia Can Be Fun For EveryoneThe Of Hard Money GeorgiaThe Only Guide to Hard Money GeorgiaGetting The Hard Money Georgia To Work

As you can see, personal money lendings are extremely adaptable. Nonetheless, maybe suggested that private loans can put both the lender and also customer in a sticky situation. hard money georgia. As an example, claim both celebrations are new to genuine estate investment. They might not understand a lot, yet they are close to each other so want to aid one another out.

In spite of them requiring to satisfy particular requirements, private lending is not as regulated as tough money financings (in some cases, it's not regulated at all). If you do go down this course, make sure you research the private lender's prices and experience thoroughly. On top of that, if you're an unskilled capitalist, have a well-thought out leave strategy prior to shooting.- Experienced financiers understand the benefits of enhancing their private money sources with a tough cash lender.

Hard Money Georgia for Dummies

Over all, they're licensed to provide to genuine estate financiers. Probably a minor disadvantage with a difficult money lending institution connects to one of the attributes that connects exclusive as well as hard money car loans law.Nevertheless, depending upon exactly how you consider it, this is likewise a toughness. It's what makes hard money loan providers the more secure alternative of both for a very first time financier and also the factor that savvy capitalists remain to go down this route. WE LEND OFFERS A VARIETY OF PROGRAMS TO FIT EVERY TYPE OF RESIDENTIAL INVESTOR.

Excitement About Hard Money Georgia

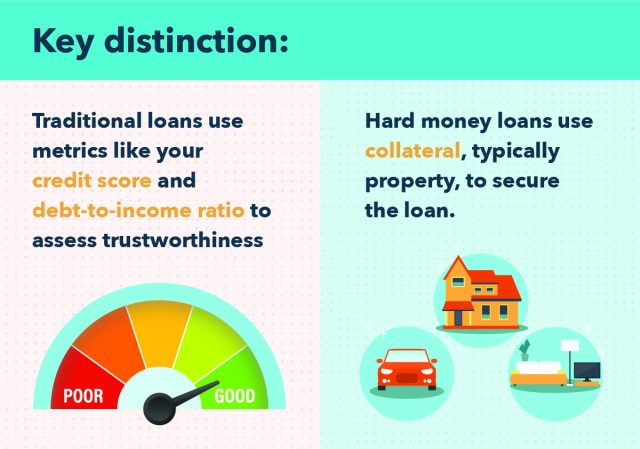

It's usually feasible to get these types of finances from personal lenders that don't have the exact same needs as traditional lenders, these personal car loans can be extra costly and less advantageous for customers, due to the fact that the risk is a lot greater. Typical loan providers will certainly take an extensive check out your whole economic situation, including your revenue, the quantity of financial obligation you owe other loan providers, your credit rating history, your other possessions (consisting of money books) as well as the size of your down settlement.

Hard money lendings have numerous benefits over business finances from banks as well as various other mainstream lending institutions. Are tough money fundings worth it? Under the right scenarios absolutely.Fast financing can be the distinction in the success or failure of an opportunity. Difficult money lenders can turn a funding application right into available money in a matter of days. Do tough money loan providers inspect credit score? Yes, but they concentrate on security most of all else. They do not examine a borrower's debt value likewise as even more controlled resources of funds. Reduced debt ratings and also some negative marks in debtors'monetary histories play a smaller function in the lender's authorization choice. In case of default, the lender has to be ensured that the earnings from sale of the home will certainly be adequate to recover the lending's unpaid major equilibrium. Somewhat, also the consumer's capability to settle the financing during the term is lesser than other choosing factors. Nevertheless, the loan provider should make certain the debtor can make the needed repayments. Fewer state and also government legislations manage tough money lenders, which enables this adaptability. Due to the fact a knockout post that of the Dodd-Frank Act, hard cash lending institutions usually do not offer for the purchase of a primary home. Difficult money car loans are a kind of different funding

that can be used for actual estate financial investment opportunities. Unlike conventional financings, which are released by financial institutions or other banks and are based largely on the consumer's creditworthiness as well as earnings, difficult cash car loans are issued by private financiers or business and also are based largely on the worth of the building being utilized as collateral. It offers the consumer an alternative to the common mortgage programs or conventional lending institutions. The most usual use these lendings are with solution & flips and also brief term financing demands. The hard cash loans that we provide are elevated through little personal financiers, hedge funds, as well as other private institutions. Due to the threat taken by the car loan carriers, rate of interest are typically higher than the typical home financings. Our items have shorter terms and also are normally for 6 months to 5 years, with rate of interest just alternatives and are not indicated to be a long-term funding option. Custom-made Home Loan Hard Money Funding Programs Include the complying with major program: 1-4 Unit Residential Characteristic consisting of Apartments, condominiums, apartment or condo houses, as well as various other special homes. This is because hard cash lending institutions are mostly concentrated on the value of the property, instead of the consumer's creditworthiness or revenue. Consequently, hard cash finances are usually used by actual estate financiers who require to safeguard financing quickly, such as when it comes to a fix and flip or a brief sale. This consists of single-family homes, multi-unit residential properties, industrial buildings, and even land.

Hard Money Georgia for Dummies

Furthermore, tough cash car loans can be utilized for both purchase as well as re-finance purchases, in addition to for construction as well as remodelling jobs. While hard money car loans can be a beneficial tool genuine estate financiers, they do come with some drawbacks. Despite these disadvantages, tough cash lendings can be an useful tool genuine estate financiers. If you are taking into consideration a tough cashcar loan, it is very important to do your research study and find a trusted lender with affordable prices and terms. In addition, it's essential to have a clear strategy in place for exactly how you will make use of the funding profits and exactly how you will certainly leave the investment. To conclude, difficult money loans are a kind of alternate financing that can be used genuine estate investment opportunities. They are released by personal capitalists or companies and also are based largely on the worth of the residential property being made use of as security. Among the main advantages of difficult cash financings is that they can be acquired rapidly as well as easily, frequently in as low check that as a couple of days. Tough money lendings normally have higher passion prices as well as charges than typical fundings, as well as have shorter terms. Debtors must carefully consider their choices as well as have a clear strategy in position before devoting to a tough cash financing. These financings are ideal for the individuals who are credit history impaired. This is because, as long as you have great security, the hard financing lenders will certainly supply you a loan also if you are insolvent. The financings are additionally ideal for the international nationals who will certainly not be offered fundings in other organizations considering that they are non-citizens of an offered nation. One great advantage is that the loans are simpler to gain access to; consequently, if you do not meetthe certifications of the conventional lender, you can quickly access the lending without undergoing extensive documents. These loan providers use investor loans alongside the rate and convenience advantages that difficult money supplies, but with more trusted closings as well as far better openness and also solution with the process. Exclusive lenders normally have extra capital to deploy and also extra trusted access to resources than tough cash lending institutions. These are two substantial factors that investors thinking check this site out about difficult money needs to explore personal lenders as well as specifically.( Last Updated On: June 1, 2022)There are many funding alternatives genuine estate financiers available today. Among the most prominent alternatives has actually become the difficult cash loan. A tough cash lending is a lending collateralized by a difficult asset (in many cases this would certainly be property).Report this wiki page